Accounting Services for Self-Employed Individuals and Private Clients

Ongoing Support and Reporting for Small Business Owners

Special Certifications for Authorities and Banks

Bookkeeping Services

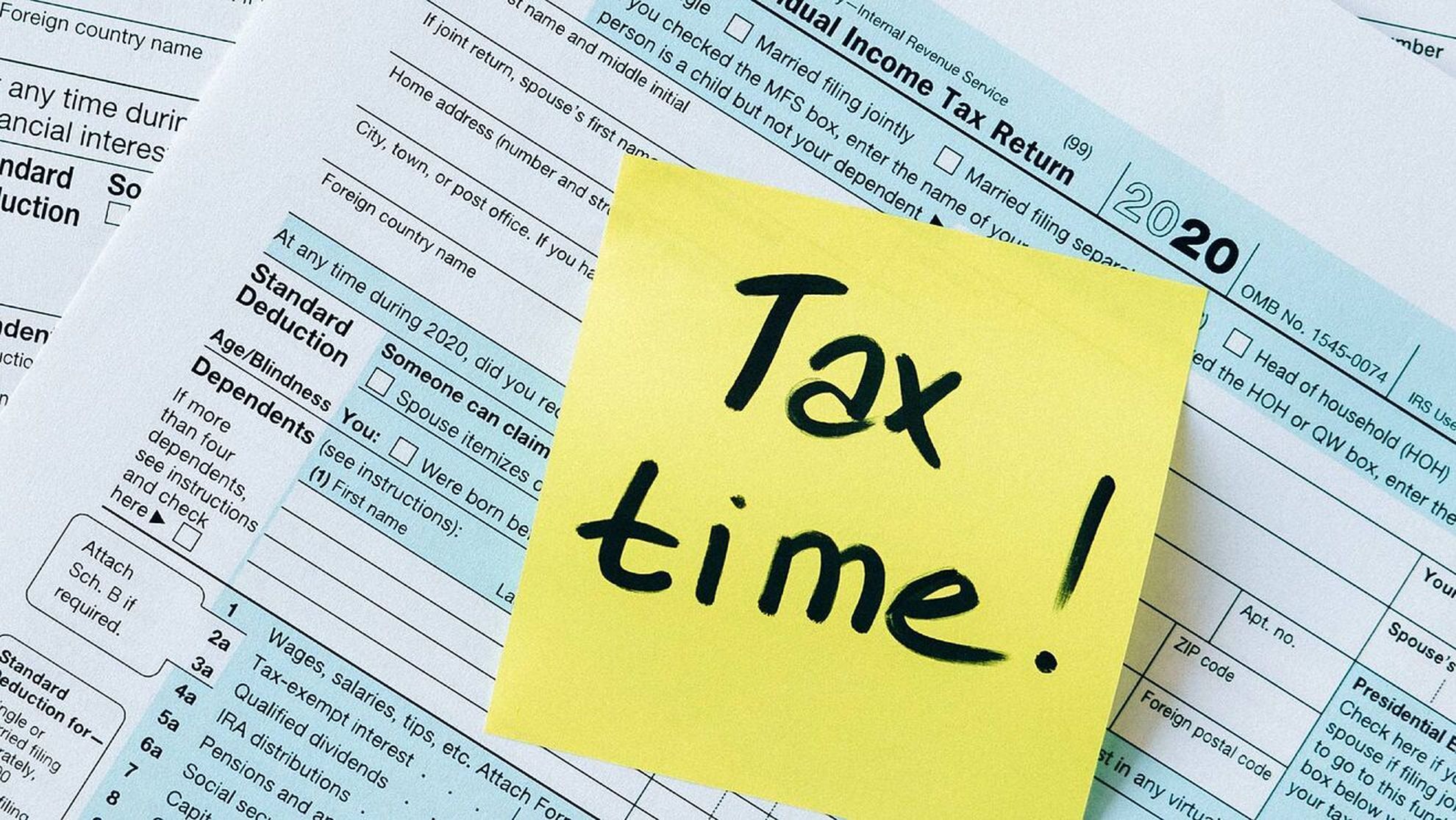

Annual Tax Filing for Individuals

Tax Refunds for Employees

High-Income Individuals

Rental Income from Properties in Israel

Israelis with Foreign Income

Non-Residents with Income in Israel

International Taxation

Articles

-

What is the Additional Tax?

As part of the government's measures to implement adjustments for compliance with the fiscal frameworks for the years 2025 to 2027, on December 26, 2024, the Economic Efficiency Law (Legislative Amendments for Achieving the Budget Objectives for the 2025 Fiscal Year) was published. As part of this law, Section 121B of the Income Tax Ordinance was amended, which deals with the 'Tax on High Incomes' (hereinafter: 'the Additional Tax'). According to Income Tax Procedure No. 5/2025 issued by the Israel Tax Authority, it was determined that an additional tax...

-

The Meaning of Opening an "Osek Patur": Obligations, Rights, and Limitations

Opening an independent business in Israel requires registering with three authorities. A “Patur” (Exempt) dealer is a type of small business that allows an individual to report their income from self-employment to the tax authorities (Income Tax, VAT, and National Insurance). A Patur business can only be registered for one person—it cannot be jointly owned. The term “exempt” in “osek patur” (exempt dealer) refers to exemption from charging VAT (Value Added Tax). Every transaction in Israel is generally subject to VAT, but exempt dealers are not required to collect VAT from their clients—provided they meet specific criteria such as staying below a certain annual income threshold...

Need help starting or managing your business?

Every business needs the right financial guidance.

I’m here to offer reliable, personalized accounting solutions tailored to your needs.

Whether you’re just getting started or expanding your business – I’m here to help.