As part of the Israeli government's efforts to meet fiscal targets for the years 2025–2027, the Economic Efficiency Law (Legislative Amendments to Achieve the 2025 Budget Goals) was published on December 26, 2024:

This law includes an amendment to Section 121B of the Income Tax Ordinance, dealing with "Tax on High Incomes" — hereafter referred to as the Additional Tax. According to Income Tax Procedure No. 5/2025, the Israel Tax Authority imposes an additional 2% tax on capital income of high-income individuals (those whose taxable income exceeds ₪721,560 in the tax year, as defined in Section 121B(e) of the Ordinance). This amendment applies to income generated or received from January 1, 2025 onward.

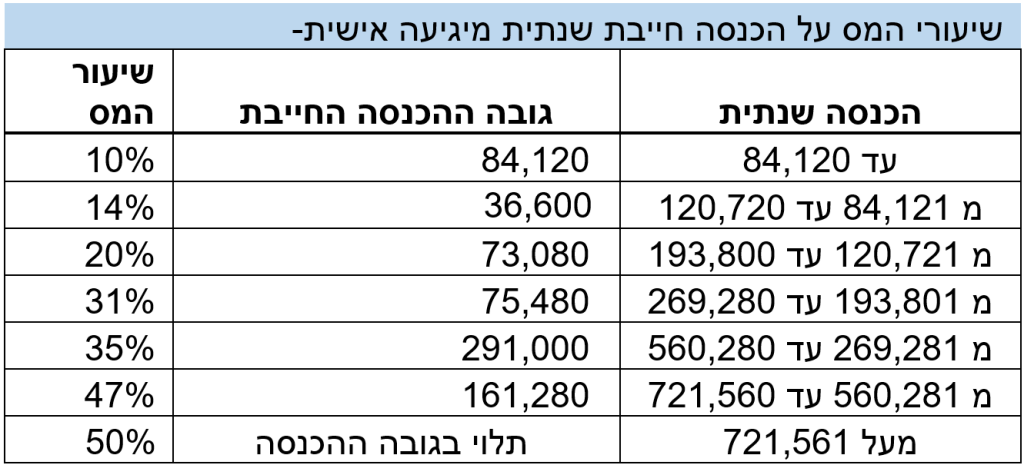

Income Tax Brackets and Earned Income

According to the 2024–2025 income tax brackets, an individual with earned income is taxed as follows:

These brackets apply to income earned between January 1 and December 31, 2025. Earned income includes wages, business income, or professional self-employment income. Additional examples of earned income:

- Pension payments.

- Survivor’s pension from someone who was eligible for a pension.

- Disability pension received from a pension fund or insurance.

- Taxable National Insurance benefits (e.g., unemployment, maternity leave, military reserve duty payments, high-risk pregnancy allowance).

- Severance or retirement grants.

- Death benefits.

- Lump-sum payments (capitalization) of pensions listed above.

- Rental income from property that, for at least 10 years prior, was used to generate earned income (e.g., business use by the owner or their spouse before passing).

Law Applicability

The amendment states that in addition to the existing surtax in Section 121B(a), an additional 2% tax will apply on capital income exceeding the threshold of ₪721,560 (for 2024–2025). Capital income includes: Dividends Interest Capital gains (including share allocations taxed as capital gains under Section 102 of the Ordinance) Rental income As long as these sources do not qualify as business income.

Examples of the Additional Tax

Example 1:

A person earns ₪1,000,000, of which ₪300,000 is from capital sources.

3% surtax (Mas Yeseph): Applies only to income above ₪721,560, i.e., on ₪278,440 → 3% × ₪278,440 = ₪8,353 2% additional tax: Applies to capital income above ₪721,560. But since the capital income is ₪300,000, and does not exceed the threshold alone, → No 2% tax in this case

Example 2:

A person earns ₪2,000,000, of which ₪1,000,000 is capital income.

3% surtax: On income above ₪721,560 → ₪1,278,440 → 3% × ₪1,278,440 = ₪38,353 2% additional tax: Capital income above ₪721,560 is ₪278,440 → 2% × ₪278,440 = ₪5,569

Payment of the Additional Tax During the Year

According to Section 121B(b) of the Ordinance, no advance payments are required for income subject to the 2% additional tax (unlike regular income tax). Employers: If salary payments exceed the ceiling set in Section 323B of the Ordinance (Regulation 6), employers must withhold the additional tax from salary. Other income (capital): No mandatory withholding or advance payment exists during the year. The taxpayer must voluntarily submit a payment in January of the following year to avoid interest or linkage penalties.