Explanation Regarding Osek Murshe Status

An Osek Murshe (licensed business) is a self-employed entity that allows an individual to report their income from independent sources to the tax authorities. An Osek Murshe can be registered for one individual only — not for multiple people. An individual can register with the VAT office as an Osek Murshe if:

- Their gross annual business income (January 1 – December 31) exceeds ₪120,000, before expenses.

- They work in one of the liberal professions listed in Section 13 of the 1976 VAT Regulations (e.g., accountant, lawyer, architect, engineer, doctor, etc.).

Income from employment (as a salaried employee) and other additional income is not considered in the threshold calculation — only income from independent business activity.

It is possible to work both as a salaried employee and as an Osek Murshe simultaneously.

Obligations of an Osek Murshe

VAT (Ma’am)

An Osek Murshe must: Charge VAT on every transaction; Issue VAT invoices; Report VAT to the Tax Authority monthly or bimonthly (depending on annual turnover).

The VAT report includes:

- Total turnover for the period.

- VAT collected on sales (Output VAT).

- VAT claimed on business expenses (Input VAT).

Income Tax

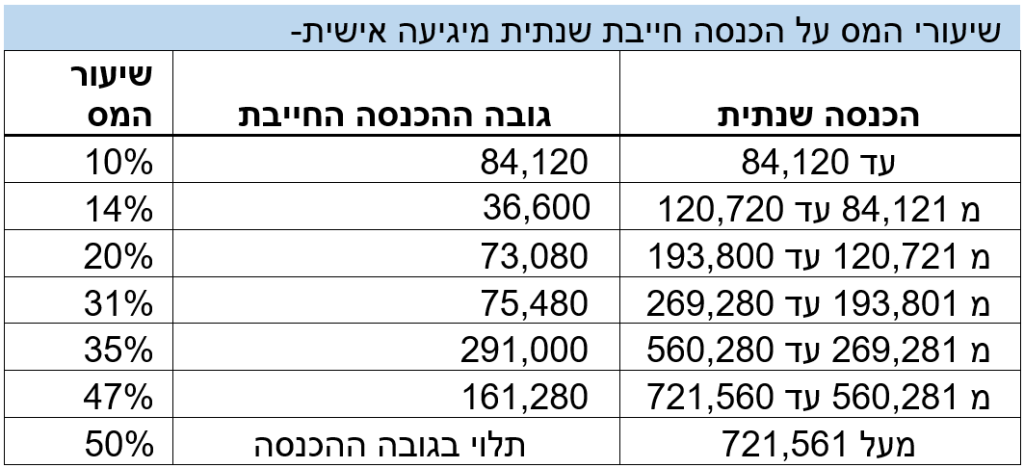

The business owner must pay income tax advances monthly or bimonthly (depending on annual turnover), as a prepayment of the final tax that will be calculated in the annual report. This method allows: The Tax Authority to receive ongoing payments. The taxpayer to spread out payments rather than paying all at once. Proper planning by an accountant — based on income forecasts and updates — helps avoid tax differences after the annual report. Tax is paid according to annual tax brackets, which are updated each year. For 2025:

National Insurance

דמי ביטוח לאומי לעוסק מורשה מחושבים כאחוז מההכנסות, נטו (הכנסות בקיזוז הוצאות). האחוז מחושב לפי 2 מדרגות. המדרגות משתנות מדי שנה. בשנת 2025:

עבור הכנסה של עד 60% מהשכר הממוצע במשק (7,522 ₪ בחודש) 7.7% מההכנסה,נטו יעברו לביטוח הלאומי.

עבור הכנסה של מ- 60% מהשכר הממוצע במשק ועד 50,695 ₪ – 18% מההכנסה, נטו יעברו לביטוח הלאומי.

בדומה למקדמות מס הכנסה, דמי ביטוח לאומי לעוסק מורשה משולמים בדרך של מקדמות. לאחר הגשת הדוח השנתי נבחנות הכנסות אל מול המקדמות ששולמו ובמידת הצורך מתקבל החזר או דרישת תשלום נוסף.

מי שהוא עד גיל 18 או מי שמקבל קצבת אזרח ותיק ישלם דמי ביטוח מופחתים.

Ongoing Services and Full Support Include:

- Representation before the tax offices.

- Initial assessment of expected annual turnover and setting tax advances accordingly.

- Guidance on record-keeping requirements according to your profession.

- Cash-based bookkeeping (single-entry).

- Income tax advance reporting (6 or 12 times per year depending on income).

- VAT reporting (6 or 12 times per year depending on income).

- Offsetting input VAT against output VAT in accordance with VAT regulations.

- Consulting and guidance on issuing tax invoices, receipts, cancellations, credit notes, and payment requests.

- Updating income reports to National Insurance up to 4 times per year.

- Personalized advice on pension and savings plans eligible for tax benefits.Guidance on optimal pension and education fund contributions for tax benefits.

- Preparing and filing the full annual report to Income Tax including all relevant appendices

- Review of recurring expense documents.

- Availability for consultation and issue resolution during the year.

- Updates on possible grants or compensation from the Tax Authority.

- Preparation of Form 6111 for businesses with annual revenue over ₪256,000.

- Comprehensive annual questionnaire to ensure you claim all your eligible rights.

Allocation Number Requirement

According to the "Invoice Israel" reform, starting in 2025, any business issuing an invoice for ₪20,000 or more must include an allocation number.

The threshold will decrease each year, and in future years invoices of ₪5,000 or more will also require an allocation number.

הסכום עבורו נדרש מספר הקצאה יורד בכל שנה ובשנים הבאות תשלומים של 5,000 ₪ ומעלה גם כן יידרשו להוציא חשבונית עם מספר הקצאה. על בעל העסק לבקש מרשות המסים מספר ההקצאה עבור כל חשבונית מס שמעל התקרה

Annual Tax Report Obligation for Osek Murshe

After the end of the tax year, an Osek Murshe must submit an annual income tax return. This report includes all income earned in Israel or abroad by the Osek Murshe and their spouse (for married couples). Required documents and appendices may include:

- Annual report from your bookkeeping software and original expense receipts.

- Depreciation report for asset purchases.

- Vehicle mileage logs for January 1 and December 31.

- National Insurance payment confirmation.

- Annual pension, education fund, life insurance, and disability insurance deposit confirmations.

- Donation receipts.

- Pension confirmations from Bituach Leumi.

- Form 867 and tax withholding statements on interest income.

- Lease agreements for real estate (residential or commercial).

- Foreign income documentation (rent, capital gains, or salary).

Capital Declaration (Hatzharat Hon)

A Statement of Assets gives the Tax Authority a full picture of a person’s financial situation and family assets. This allows the authority to verify the accuracy of reported income by comparing changes in asset value between two points in time (initial vs. follow-up statement), and checking whether changes match reported profits. Thus, the Statement of Assets functions as a reliability and accuracy check.

Service Cost

Fees are determined based on the complexity of the business, whether income tax advances are required, and how many additional forms must be included beyond the self-employed business report. Feel free to contact me for a personalized quote for your annual report as an Osek Murshe and/or Statement of Assets.